All Categories

Featured

Table of Contents

The payments that would certainly have or else gone to a financial establishment are paid back to your individual pool that would certainly have been made use of. Even more money goes right into your system, and each dollar is executing multiple tasks.

This cash can be utilized tax-free. The money you utilize can be paid back at your leisure with no collection settlement routine.

This is exactly how family members hand down systems of wealth that enable the future generation to follow their dreams, begin organizations, and make the most of possibilities without losing it all to estate and inheritance tax obligations. Corporations and banking organizations utilize this method to produce working pools of funding for their companies.

Generational Wealth With Infinite Banking

Walt Disney utilized this approach to begin his imagine constructing a theme park for youngsters. We would certainly enjoy to share extra instances. The inquiry is, what do desire? Comfort? Financial protection? An audio financial option that doesn't rely upon a changing market? To have cash money for emergency situations and opportunities? To have something to pass on to individuals you love? Are you going to find out more? Financial Preparation Has Failed.

Sign up with among our webinars, or attend an IBC boot camp, all complimentary of cost. At no charge to you, we will educate you a lot more concerning just how IBC functions, and create with you a strategy that functions to address your problem. There is no responsibility at any kind of factor while doing so.

This is life. This is heritage.

It appears like the name of this principle modifications once a month. You might have heard it referred to as a perpetual riches technique, household financial, or circle of wide range. Regardless of what name it's called, boundless banking is pitched as a secret method to build riches that just abundant individuals learn about.

How does Policy Loans compare to traditional investment strategies?

You, the insurance policy holder, placed money right into a whole life insurance policy plan with paying premiums and buying paid-up enhancements. This increases the cash worth of the plan, which means there is more money for the returns rate to be applied to, which usually means a higher price of return overall. Dividend prices at major service providers are currently around 5% to 6%.

The entire idea of "financial on yourself" just works because you can "financial institution" on yourself by taking fundings from the policy (the arrow in the chart over going from entire life insurance policy back to the insurance holder). There are two different kinds of car loans the insurance provider may supply, either direct recognition or non-direct acknowledgment.

One attribute called "laundry finances" establishes the rate of interest on lendings to the exact same rate as the reward price. This indicates you can obtain from the plan without paying interest or getting interest on the quantity you borrow. The draw of boundless banking is a reward rates of interest and ensured minimal rate of return.

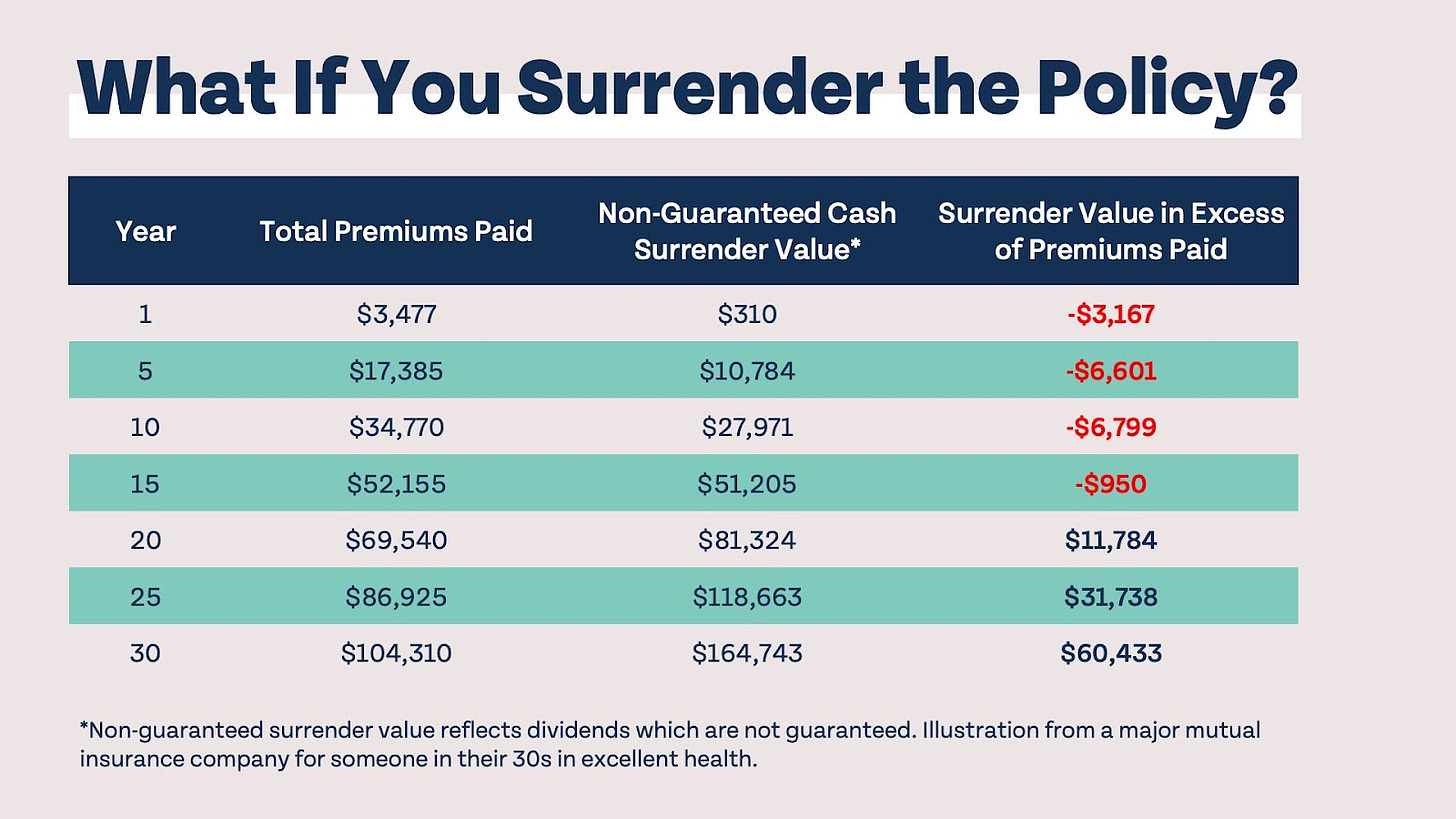

The drawbacks of unlimited financial are typically ignored or not discussed whatsoever (much of the information readily available concerning this concept is from insurance policy agents, which might be a little biased). Just the cash value is expanding at the returns rate. You also need to spend for the cost of insurance policy, costs, and expenditures.

Borrowing Against Cash Value

Every long-term life insurance policy is different, however it's clear a person's total return on every dollar invested on an insurance coverage product could not be anywhere close to the dividend price for the policy.

To offer a really standard and hypothetical example, let's presume someone has the ability to earn 3%, usually, for every single dollar they invest in an "unlimited banking" insurance item (besides expenditures and fees). This is double the approximated return of whole life insurance policy from Customer Reports of 1.5%. If we presume those dollars would certainly be subject to 50% in taxes complete otherwise in the insurance item, the tax-adjusted rate of return can be 4.5%.

We assume more than average returns overall life item and an extremely high tax price on dollars not put right into the plan (that makes the insurance product look much better). The reality for several people may be even worse. This pales in comparison to the long-term return of the S&P 500 of over 10%.

Is Infinite Banking For Retirement a good strategy for generational wealth?

Unlimited banking is a great item for agents that offer insurance, however might not be optimum when compared to the less costly alternatives (with no sales individuals earning fat compensations). Right here's a breakdown of several of the various other supposed benefits of boundless banking and why they may not be all they're gone crazy to be.

At the end of the day you are buying an insurance item. We enjoy the protection that insurance coverage uses, which can be acquired much less expensively from a low-cost term life insurance plan. Overdue fundings from the policy might likewise minimize your survivor benefit, diminishing an additional degree of defense in the policy.

The idea just functions when you not only pay the considerable costs, yet use extra money to acquire paid-up additions. The possibility expense of all of those dollars is significant very so when you might rather be investing in a Roth Individual Retirement Account, HSA, or 401(k). Also when contrasted to a taxable investment account or perhaps an interest-bearing account, limitless banking might not offer similar returns (contrasted to spending) and equivalent liquidity, gain access to, and low/no cost framework (contrasted to a high-yield interest-bearing accounts).

Several individuals have never ever heard of Infinite Financial. Infinite Financial is a way to manage your cash in which you develop a personal financial institution that works just like a normal financial institution. What does that imply?

Can I access my money easily with Infinite Banking Wealth Strategy?

And many thanks to the cash value financial savings section of your whole life insurance policy plan, you're able to take plan fundings that will not interfere with the development of your money. Bank on yourself. Therefore, you can finance anything you need and want, i.e.,. Just put, you're doing the banking, but as opposed to depending upon the traditional bank, you have your very own system and complete control.

Infinite Banking isn't called in this way without a reasonwe have unlimited methods of executing this process right into our lives in order to genuinely own our way of life. In today's short article, we'll reveal you four various ways to use Infinite Financial in service. We'll discuss 6 ways you can make use of Infinite Financial personally.

Table of Contents

Latest Posts

Bank On Whole Life

How To Create Your Own Bank

Cash Flow Banking Insurance

More

Latest Posts

Bank On Whole Life

How To Create Your Own Bank

Cash Flow Banking Insurance